ArtsThrive

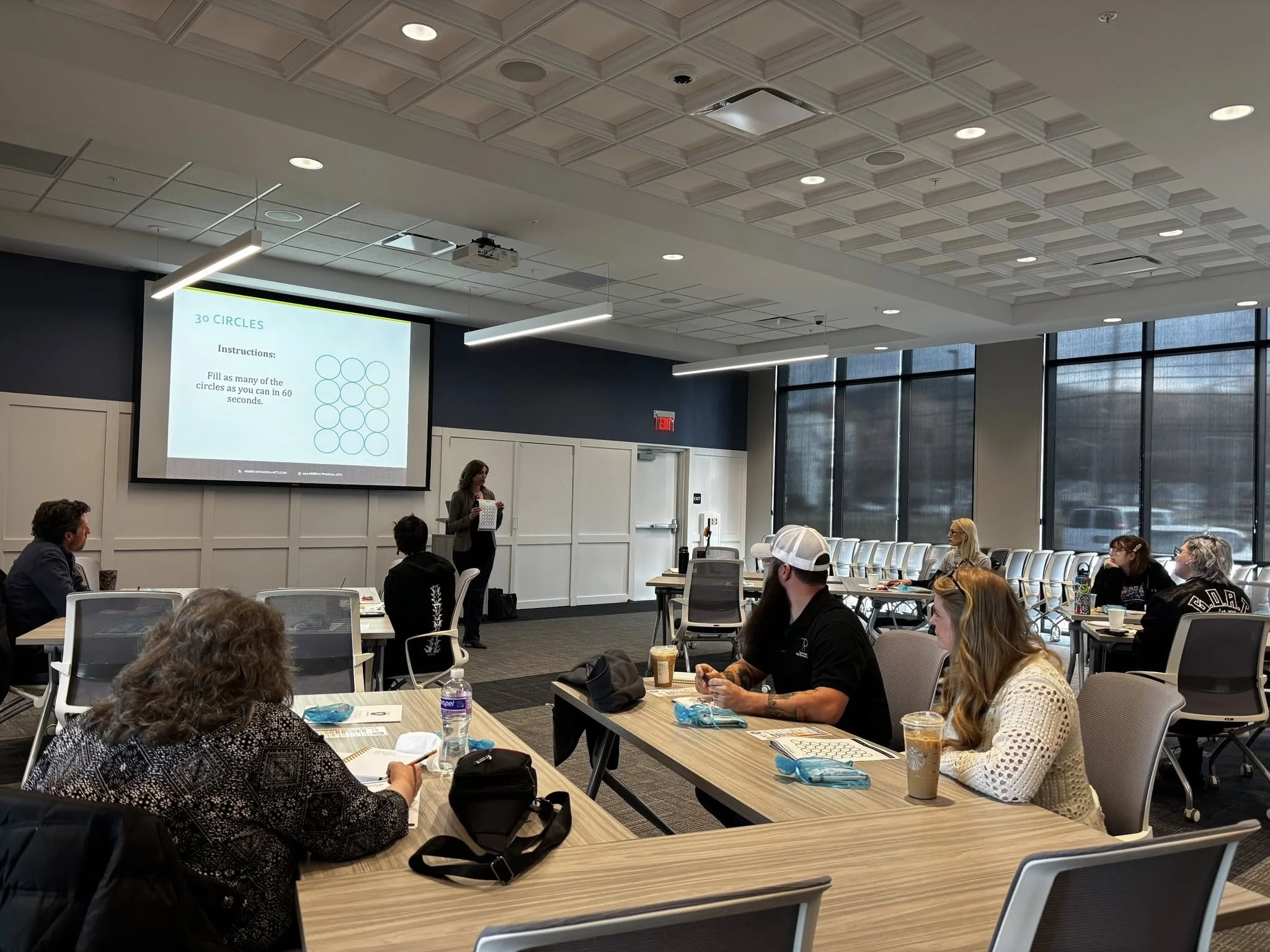

ArtsThrive: Grant Writing That Wins

Saturday, March 7, 2026 | 9:00 AM - 12:00 PM

Want to learn more about grant writing? What tools or resources are out there to equip you to write grants? Join TAP's ArtsThrive Workshop, tailored specifically for the creative sector in grant writing! This hands-on session with panelists and guest speakers will educate artists, board members, and cultural organizations with the practical skills needed to secure funding for innovative projects. Participants will learn how to identify relevant grants, craft compelling proposals, and effectively communicate the value of their work.

Whether you’re new to grant writing or looking to sharpen your approach, this workshop offers expert guidance, peer feedback, and real-world examples to help unlock new opportunities for your creative endeavors.

What Makes a Stellar Grant? Best Practices and Tips for Grant Writing

Panelists: Keith Green, Diane Lautenschleger, and David Mitchell

Making the Case: What Funders Wish You Knew Before You Apply

Guest Speaker: John Maxwell, Tuscarawas County Community Foundation

Topics To Expect

Thank you to First Federal Community Bank for being our facility sponsor for the ArtsThrive Program!

Exploring the OAC: A conversation about Ohio Arts Council Grant Programs and Funding Opportunities

Guest Speaker: Patrick Roehenbeck, Ohio Arts Council Organization Program Coordinator